According to a Citywire report, forecasts from the Office for Budget Responsibility (OBR) suggest the amount of Inheritance Tax (IHT) paid to HMRC will have increased by 11.6% in 2024/25 compared to 2023/24.

This will mean that the total amount of IHT paid in the 2024/25 financial year will have reached a record high of £8.4 billion.

The report suggests that the big year-on-year increase has been primarily driven by the long-term freeze of the level at which IHT becomes chargeable, and the increase in asset values.

With the freeze on thresholds due to continue until 2030, this highlights the importance of ensuring you are taking effective estate planning measures to mitigate the amount of IHT payable on the value of your assets. Doing this can help ensure that your beneficiaries are not left with an unwelcome and substantial tax charge on your death.

There are series of straightforward measures you can make use of to reduce your IHT liability. One of these, which is often overlooked, is known as “gifting from surplus income”.

In this article you can read about how it works, and help ensure that as much of your wealth as possible passes to your beneficiaries rather than HMRC.

Gifting assets is an effective way to reduce your IHT liability

In the 2025/26 tax year, IHT is normally charged at 40% on the value of your estate in excess of the £325,000 allowance, commonly referred to as your “nil-rate band”.

If your primary residential property is included in your estate and it is passed to a direct descendant, your total tax-free allowance will likely increase to £500,000.

It’s also important to bear in mind that these allowances apply to individuals, so a couple can enjoy a combined tax-free allowance of up to £1 million.

The most common and straightforward way to reduce your IHT liability is by gifting assets – belongings, investments, or cash – to your beneficiaries during your lifetime, so they no longer form part of your estate.

You have three annual gift allowances you can make use of:

- A £3,000 annual exemption, which can be split among as many recipients as you like. You can “carry forward” any unused allowance from one year into the next. This means that you and your spouse or partner could gift £12,000 immediately if you have not previously made any gifts

- Wedding gift allowances of £5,000 for a child’s wedding, £2,500 for a grandchild’s wedding, or £1,000 for anyone else. This exemption counts in addition to the standard annual exemption.

- Unlimited small gifts of £250 or less to other individuals, provided they have not been the recipient of another of the above exemptions.

Beyond these three allowances, all other gifts you make will be treated as potentially exempt transfers (PETs) and subject to the “seven-year rule”.

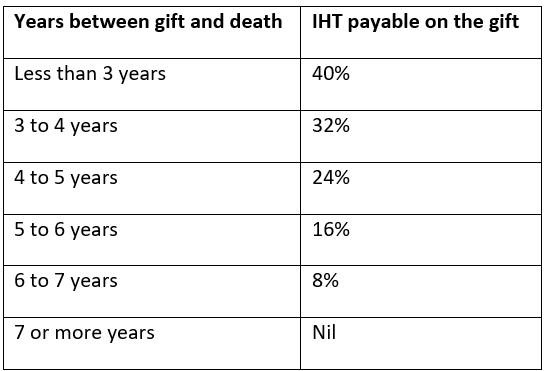

This means that if you live for seven years from the date of making the PET, no IHT will be payable. Within those seven years, however, a taper relief system is applied, which means that the amount of IHT will depend on how long you live after making the gift.

As well as allowable gifts and PETs, a further effective way to mitigate your IHT liability is by utilising the “gifts out of surplus income” rule.

Gifts out of income are usually Inheritance Tax-free

Making gifts out of your regular income is an effective estate planning measure. Not only are these gifts usually IHT-free, making them carries the added benefit of you being able to provide the recipient of your gifts with valuable ongoing financial support.

While there is no limit to the amount you can gift in this way, there are three strict conditions you need to comply with:

- You must be able to demonstrate that the gifts you make are from your income, such as your salary or regular pension, rather than your accrued capital.

- The gifts must be made on a regular basis and not simply be one-off transfers.

- By gifting from your income, you must ensure that you are not reducing your own standard of living, and that the income in question is surplus to your requirements.

As well as not reducing your living standards, you will also need to assess how making such gifts on a regular basis could affect your own long-term financial plans.

You will need to review your own arrangements to confirm that the gifts you make are affordable when set against your other priorities, and that you are not creating future problems for yourself if the money you are gifting could be better allocated for other uses.

For example, you might you better off setting money aside for future care provision, or to cover moving costs if you intend to downsize to a smaller property.

You should also carefully consider how any gifts of this kind will be used. Earmarking these for a specific purpose can often be advantageous. This could include paying annual school fees for your grandchildren, or putting regular amounts into a Junior ISA, that they can then access when they are 18.

You should keep accurate records of all gifts you make

As with all your personal finance transactions, it’s important to keep detailed records of all gifts you make, whether they are out of income, within your gift allowance, or PETs.

This is certainly the case when it comes to gifts out of income and substantial PETs, as your executors are likely to need to provide these to HMRC when they are dealing with your estate on your death.

Accurate records can help expedite the process of obtaining probate, and ensure that your beneficiaries are able to enjoy your bequest to them without any unnecessary delay.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning or estate planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Barrington Hamilton is not responsible for the accuracy of the information contained within linked sites.